Meaning of a Dormant Company

Dormant companies dont actively engage in trading or business activities and earn no income.The advantages of seeking dormant status for your company are that it fixes your cost of company incorporation and helps in increasing the valuation of your company the longer it exists, the more its value.you can read more about "Dormant Company"here

Dormant companies may exist for the following reasons, in general:

To reserve a company name

To set up a structure for projects in the future

To modify the organization of your company

To accommodate for absence of the business owner

To serve as a holding structure for assets or intellectual propertyTo serve as an intermediate step before company dissolution

Before you apply for dormant status, you must inform the appropriate tax authorities in your country of tax residence as well as the government body that registered your company in the first place.

For Newly Formed Companies

If youre a recently-formed company and have not filed any taxes so far, most jurisdictions will allow you to receive dormant status with no fuss.

You can also register your company with the express purpose of becoming dormant. For this, you just need to inform the national Registrar of Companies after company registration has been completed in the regular manner.For Companies that Have Previously Earned Income or Conducted BusinessExisting companies need to ensure that there is no outstanding due to any party in business or the government. Listed below are the pre-conditions for existing companies to gain dormant status.No lawful inquiries or investigations must be pendingNo bills, dues, interest, or fees must be left unpaid to any party (supplier, vendor, or partner)No active contract with a separate entity must be running to which the company is a partyNo income tax, VAT, or GST must be owed by the companyAgreements with clients or customers must have been fulfilled and respective accounts closedNo employees to be on company rolls and claims of previous employees must have been settled (including CPF, gratuity, and other social security contributions)All bank accounts in the name of the establishment must have been closedNo dues must be owed to local authorities, state or central government agencies, including for licenses or permits.

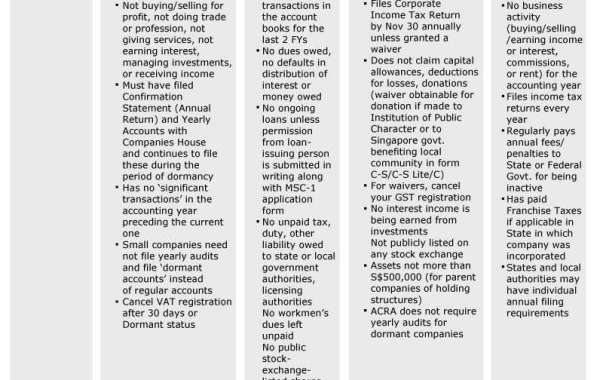

Dormant Company Pre-Requirements by Country for Existing Companies

How to Apply for Dormant Company Status: Procedure and CompliancesUKSend a mail to the regional Corporation Tax office regarding the intended date of dormancy.You will be sent a Notice to deliver company tax return. Reply to this mail by filing the returns online and pay any unpaid taxes.HMRC to convey the acceptance of your dormant status in about 21 days after your communication.

Singapore

FulfillIRASconditions for dormant status over the previous 12-months:No sale/purchase to or from customers, suppliers, or of assetsNo issuance of dividends to holders of shares

No loans outstanding to lenders

FulfillACRAconditions over the previous 12-month period

Assets (consolidated assets for parent company) are worth less than S$500,000Company remained dormant since it was registered

Directors to file declaration that company has been dormant for the claimed periodNo claims received under Section 201A(3) of the Singapore Companies ActNo claims received under Section 199 of the Singapore Companies Act

All dormant companies must file annual returns except if they qualify for a waiver as below:The Company is not listedThe Company is not a subsidiary of a listed company that has gone dormantCompany is not listed by assets are worth more than S$500,000All dormant companies must file tax returns with the IRAS, except if they qualify for a waiver as below:Waiver application filed by Director, CS, or Approver, andForm C-S/C has been filed complete in respect of financial statements, revenues, Director fees, assets, etc, till the day dormancy commencesDe-registration from the GSTUndertaking to not start again for a period of 2 years henceWaiver for return exemption renewed yearly.

India

Submit the MSC-1 form along with the applicable fees

Approval of 75% of shareholders by value (either via notice to shareholders or by a special Board resolution.Obtain the form MSC-2 from the RoC.

Company name appears in the Register of Dormant Companies.

The Dormant company shall maintain a minimum of 1 Director for a One Person Company, 2 for a Private Limited Company, and 3 for a Public Limited Company.Dormant company holds one meeting every 6 months with at least 3 months/90 days between each meeting.

Chartered Accountant to audit annual returns prepared by the company every year in form MSC-3.The RoC can also declare that a company is dormant if financial statements and returns have not been filed for 2 consecutive accounting periods.Dormant companies need not rotate their auditors.

Cash flow statement need not be filed in annual statements

There is a limit of 5 years up until which a dormant company can remain on the register of companies. Post this period its name will be struck off.

USA

In the US, a corporation can become inactive if it ceases doing business. When you file annual reports and tax returns your inactive (dormant) status will be conveyed to the IRS and the Secretary of State for business in the state, county, or other jurisdiction.

The Secretary of State can also declare that a corporation is inactive if the corporation fails to file annual reports or tax returns for 2 consecutive accounting periods.

Note that your company can become void if it does not file annual reports and taxes.

Your company could also become forfeited if your registered agent leaves the company and is not replaced.

You would have to continue filing annual statements and income tax returns if you wish to continue your inactive status.

Some states may levy a minimum amount as taxes on corporations even if they stay inactive. Some charge penalties for being inactive.

You would also have to continue paying license or other fees for engaging in a business activity whether youre active or not.For these reasons it can quickly become expensive to maintain a dormant company in the US.

you can read more onOdint Consulting